National Institute for Aviation Research at Wichita State University

The aerospace industry remains one of the primary users of composite materials. In 2018, aerospace and defense accounted for nearly 50% of revenue shares in the carbon fiber market – nearly as much as automotive, alternative energy, construction, infrastructure and sporting goods combined, according to a report by Morder Intelligence, a market intelligence and advisory firm. The report adds that the increased use of carbon fiber in aircraft, coupled with the rising number of aircraft launched in the market each year, is expected to provide a huge growth opportunity for the carbon fiber market between 2019 and 2024.

Last year, Boeing released its Commercial Market Outlook 2019-2038 report, which supports Morder Intelligence’s assertion about the increase in aircraft deliveries. According to Boeing, the air travel market is projected to be 2.5 times larger in 20 years. To accommodate such growth, the global commercial jet fleet will double in size by 2038, with the production and delivery of more than 44,000 jets. In addition, Boeing’s report suggests that more than 75% of the existing fleet will need to be replaced during the next 20 years – almost 19,000 jets.

In order to meet aggressive demand in aerospace, the composites industry needs to consider more than material development and supply: Manufacturing processes must undergo significant technology advancements, and future engineers must be equipped with advanced hybrid, scalable, flexible and extensible tools to adapt to growing complexities. Global aircraft manufacturers are actively seeking methods for advancing manufacturing technologies through automation and innovative materials/processes that increase manufacturing rates and efficiency. They have an eye toward the “Factory of the Future” – also known as Industry 4.0 or smart manufacturing – where information technology and operational technology unite.

With the advancement of sensor technologies and manipulators, industrial robots are now capable of performing non-routine complex functions, such as labor-intensive advanced composite lay-up that typically require meticulous, trained technicians. Rapid tooling concepts with additive manufacturing technologies, coupled with automated fiber placement (AFP), have the potential to significantly decrease lead time and increase material yield and production rates due to fewer interruptions and improved consistency. With the use of advanced sensors, process simulation software and in-process inspection systems, labor-intensive non-destructive inspection for quality assurance can be automated to minimize interruptions and significantly improve part quality. In-process inspection systems equipped with advanced sensors can be deployed for automatically identifying manufacturing defects and feeding digital information into machine learning algorithms to take corrective actions on subsequent manufacturing runs to improve part quality. This approach, which develops a digital manufacturing twin for supporting sustainment activities, fits well into the Factory of the Future concept and will aid in increasing production rates of commercial and defense aircraft.

To successfully integrate traditional design and manufacturing processes with novel advanced technologies, manufacturing engineering education programs must be enhanced to prepare future engineers with the tools and applied learning experience necessary to apply scientific, mathematics and engineering principles during production. The National Institute for Aviation Research (NIAR) at Wichita State University (WSU) is one of several organizations striving to accelerate innovation by investing in industry-relevant advanced manufacturing technologies. NIAR Advanced Technology Laboratory for Aerospace Systems (ATLAS) has several strategic partnerships to encapsulate technologies for creating a digital thread that connects design and manufacturing elements to effectively integrate all aspects of the manufacturing process.

Recent advances in heating technologies and automated manufacturing technologies have enabled the use of thermoplastics in automated manufacturing processes. In-situ consolidation eliminates secondary processes, such as vacuum bagging and autoclave/oven curing, thereby significantly reducing manufacturing costs and increasing production rates. Furthermore, with highly-adaptable automated toolless manufacturing technology, robot movements are coordinated to produce 3D composite parts out-of-autoclave. This is analogous to additive manufacturing with the added enhancement of continuous fibers for structural application. With this technology, parts can be manufactured from 3D CAD drawings for rapid manufacturing with digital twin, as-built copy for supporting sustainment.

The future outlook for composites in the aerospace industry is bright, but it requires collaboration among government agencies, aircraft manufacturers, equipment suppliers, material suppliers and universities to ensure we are developing the right materials, as well as creating streamlined technologies and manufacturing processes that can meet the growing demand for aircraft.

The Chinese Market

By Ray Liang, Ph.D., Director and Chief Scientist

The i-Center for Composites

Managing Director, NSF Center for Integration of Composites into Infrastructure

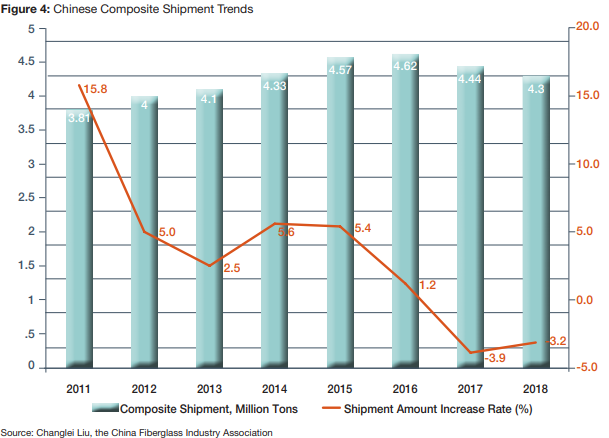

China’s glass fiber and composites production has been leading the world for the past several years, with glass fiber production exceeding 60% of the world’s total output. For the past several years, the annual production capacity of glass fiber in the Chinese composites industry has exceeded 5.5 million metric tons and the annual composite shipment has been more than 4 million metric tons. However, numbers have dipped in the past couple of years. The total shipment of composite products in 2018 was 4.3 million metric tons, a decrease of 3.15% compared to 2017. This reduction continued in 2019, with the total production of composite products decreasing by 8.5% from January through September compared to 2018.

This downward trend occurred primarily because the Chinese government and composites industry have enforced several regulations on environmental protection and other industry standards since 2017, leading to the closing of a large number of composites manufacturing plants and companies. The entire Chinese composites industry is undergoing transformation in an effort to promote more innovation, higher productivity, environmentally-friendly operations, a lower waste rate, more optimized operations and more efficient management.

However, even though the total shipment is slightly reduced, leading Chinese composite companies are receiving more orders, increasing profits and growing rapidly, which is viewed as a direct benefit and outcome of industry-wide restructuring and optimization initiatives.

Major markets for GFRP in China include wind power, vessels and tanks for the oil and gas industry, new rural construction and lightweight building materials. The rapid development of downstream market segments such as windmills, solar panels and frames, automotive, rail transit, modular and portable housing, modern farming and animal husbandry, intelligent logistics, 5G communications and other fields contribute to the healthy market size of GFRP and CFRP composites.

The Chinese carbon fiber composites industry has grown steadily for the past several years. There are six companies capable of producing more than 1,000 tons of carbon fiber annually. Currently, domestic production of carbon fiber is about 8,000 tons, while the total consumption of carbon fiber is 30,000 tons, reflecting an import of 22,000 tons to meet national market needs. The Chinese carbon fiber industry is still in its infancy, and it will take time for the newly-developed industry to mature.

Most users of carbon fiber still place more trust in imported carbon fiber products for their consistency in quality and performance. Thus, it is not production capability, equipment or processes that limit the growth of carbon fiber in China. Instead, market acceptance is forming the bottle neck for the Chinese carbon fiber industry. For many applications, use of domestically-produced carbon fiber needs re-certification. It is expected that by 2025, the Chinese carbon fiber industry will reach a breakpoint and domestically-produced carbon fiber composites will surpass the imported amount.

Like glass fiber, the carbon fiber industry also has undergone restructuring and optimization, with several carbon fiber companies declaring bankruptcy last year. The driving applications for CFRP in China are within the wind energy industry, electricity transmission, electric vehicles, the 3Cs (computers, cell phones and communications, including 5G), sports and city transit.

Overall, the composite industry in China faces strict environmental regulations, price increases in chemical and raw materials, cost increase in labor and rising energy costs. Achieving competitiveness through innovation is key. For example, traditional hand lay-up manufacturing has been gradually phased out in China. Currently, there is a need for advanced manufacturing equipment, including closed molding technologies. Automation will also become a necessity to make operations more competitive.

In 2019, the U.S./China trade war worsened, and it appears it may not end soon. Multilateral trade, including China-EU trade, is affected, and global trade tensions are escalating. At present, fiberglass, carbon fiber, basalt fiber and all composite products have been included in the United States plus-25% tariff list. These global trade uncertainties have forced the Chinese composites industry to expand domestic markets.

In conclusion, the future healthy growth of the Chinese composites industry will rely more on scientific and technological innovation and product quality improvement, rather than on resources, low-cost labor and an expanding production capacity. New initiatives from the government related to rural area construction, modern agriculture and farming, and 5G communications will expand existing applications and open up new ones for composite materials and structures. Looking ahead, composites have a bright future in China.

Thanks to Changlei Liu of the China Fiberglass Industry Association and Professor Jian Xu of Shenzhen University for contributions to this section.

The European Market

By Elmar Witten, Managing Director

AVK, the German Federation of Reinforced Plastics

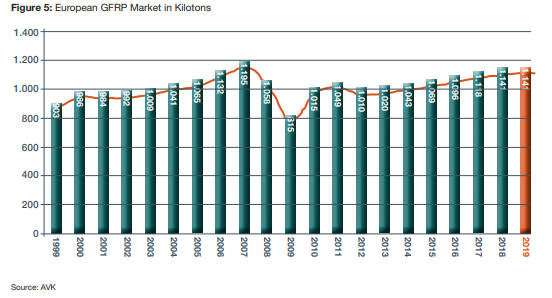

After six successive years of modest growth, European GFRP production remained steady in 2019 at a total volume of 1.14 metric tons. The stagnation did not affect all areas equally. Some growth occurred in thermoplastic processes, sheet molding compound (SMC)/bulk molding compound (BMC), resin transfer molding (RTM) and pultrusion. In addition, some eastern European countries and Turkey expected growth in 2019. Overall, glass fiber remained the dominant material by far, used for reinforcement in more than 95% of the total volume of composites. Global demand for CFRP was estimated at 141,500 metric tons in 2019, or 1% to 2% of the market.

The two main market segments for GFRP in Europe remain construction/infrastructure and transportation, each accounting for approximately one-third the total production volume. For the first time in many years, the construction/infrastructure market segment is now a larger consumer of GFRP at 36% of the total European market compared to the transport sector (34%). The two other areas with significant market share in 2019 were electric/electronics at 15% and sports/leisure at 14%.

In recent years, GFRP production has grown more slowly in Europe than in America and Asia. Reasons for this sluggish growth include the migration of certain manufacturing processes and methods, as well as outsourcing of the production of commodities with often low-profit margins. In addition, some specific applications and customer industries, such as automotive, are growing more dynamically in other regions of the world than in Europe.

The automotive sector, one of the central pillars of the composites industry, is now undergoing a massive transformation with changing material requirements, new challenges in drive technology and construction and innovations such as autonomous driving systems. Countries with large export surpluses in this sector, such as Germany, are hardest hit by any slow-down in the market. This affects not only OEMs, but the entire supply chain, including composites fabricators and material suppliers.

It’s important to note that market trends within Europe vary widely from country to country. While the overall market stagnated year-on-year at 1.14 metric tons, growth rates in Europe ranged from -2.55% to +4.35%. The largest European country in the GFRP/composites market continues to be Germany, with a total production volume of 225,000 metric tons (down 1.75% from 2018). Only Eastern European nations registered growth last year. Production in the United Kingdom, Ireland, Austria and Switzerland was stable. All other countries anticipated production to fall in 2019.

The overall mood within the composites sector is subdued, fueled by growing stock market uncertainty, declining rates of investment and a generally turbulent economic climate. The gross domestic product (GDP) indicators for Europe as a whole – and many of its national economies – are currently starting to turn downward. The market is also adversely affected by growing political uncertainties within the European Union and in international trade. Brexit, trade disputes between the United States and China and the protectionist policies of various countries are creating insecurity.

Despite these challenges to the European composites industry, there is promise. Some areas show tremendous potential, such as construction of the 5G network and renovation of bridges and buildings. However, awareness of composite materials is still too low for them to be widely considered by end user decision-makers. This must change because composites are a good, if not better choice for many applications. If customers can reassess these materials and composites become subject to standards/norms, then market growth is assured for years to come.