Six industry experts focus on the future of composites.

In 2019, Composites Manufacturing magazine covered innovations throughout the industry, from experimental wind turbines and structural composites on electric vehicles to 3D tooling and automated manufacturing operations. The editorial team is excited to see what’s in store for 2020. We kick off the New Year with our annual State of the Industry report, looking at key materials and markets in the industry.

The Glass Fiber Market

By Sanjay Mazumdar, CEO

Lucintel

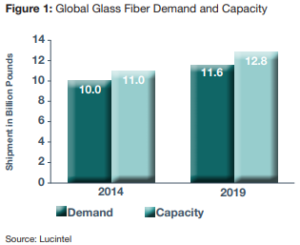

Against the backdrop of unresolved U.S./China trade disputes, the U.S. composites industry remains positive and continues to show growth, driven particularly by the wind energy, aerospace and construction industries. Overall, the U.S. composite end products market was valued at $26.7 billion in 2019 and is forecast to grow at 3.8% compound annual growth rate (CAGR) in the next five years to reach $33.4 billion in 2025. Glass fiber-based composites dominate the market, followed by carbon fiber-based composites.

In the U.S., glass fiber is a major reinforcing material, growing by 1.7% in 2019 and reaching 2.6 billion pounds in terms of volume and $2.2 billion in terms of value. The glass fiber demand for the U.S. is expected to reach 3 billion pounds by 2025 with a CAGR of 2.4%.

Owens Corning, Jushi, Nippon Electric Glass, CPIC and Johns Manville are some of the top suppliers of glass fiber in the U.S. The glass fiber industry is quite consolidated, with the top three companies accounting for more than 50% of the total output by value.

The main consumers of glass fiber in the U.S. are the transportation (including automotive), construction, and pipe and tank segments. Together, they represent 69% of the total usage. Future trends indicate that these key sectors offer significant growth potential for the U.S. composites industry. Increasing residential and commercial construction, continuous growth in oil and gas activities and water/wastewater infrastructure, and rising demand for lightweight vehicles are expected to drive this market.

The transportation market, which includes buses, coaches, commercial vehicles and automobiles, is expected to be one of the biggest U.S. markets in the next five to 10 years. Key vehicle manufacturers are investing in composite materials technology to reduce weight and meet the legislated carbon emission reduction targets.

The transportation market, which includes buses, coaches, commercial vehicles and automobiles, is expected to be one of the biggest U.S. markets in the next five to 10 years. Key vehicle manufacturers are investing in composite materials technology to reduce weight and meet the legislated carbon emission reduction targets.

In the construction industry, common applications for GFRP include paneling, bathrooms and shower stalls, doors and windows. Glass fiber demand in construction registered 1.5% growth in 2019 in terms of value shipment. The growth is driven by a continuous increase in employment, low mortgage rates and slowing house price inflation.

The continued easing of lending standards and increased funding support from state and local construction measures are other major drivers for the U.S. construction market.

Due to climate change and the occurrence of natural calamities (like earthquakes and hurricanes), the major challenges facing U.S. infrastructure require strong research efforts and increased use of advanced technologies and materials. Composites are increasingly being used to repair and retrofit structures built with other materials.

The pipe and tank market was flat in 2019 as oil and gas activities declined due to disruption by Hurricane Barry in the Gulf of Mexico and slow growth in oil demand. FRP pipes and tanks are not only used in oil and gas applications, but also have huge opportunities in chemical, industrial, water/wastewater and sewage applications. According to the Environmental Protection Agency, more than 40% of water pipelines are in poor to life-elapsed conditions and require correction (repairs for old pipes and installation of new pipes), which, in turn, will drive demand for FRP pipes.

In terms of supply and demand, global glass fiber capacity was 12.8 billion pounds in 2019 and is currently running at 91% utilization. Lucintel predicts that the fiberglass plant capacity utilization will go down slightly to approximately 90% in 2020 as glass fiber producers add more production capacities.

To fulfill the increasing demand for glass fiber in various applications, companies are trying to grow both organically and inorganically. In 2019, Jushi USA put its alkali-free fiber production line into operation with an annual capacity of 96,000 tons and a total investment of $350 million, whereas Nippon Electrical Glass acquired the remaining PPG USA fiberglass operations in 2017-18 with a value of $550 million.

The Carbon Fiber Market

By Daniel Pichler, Managing Director

CarbConsult GmbH

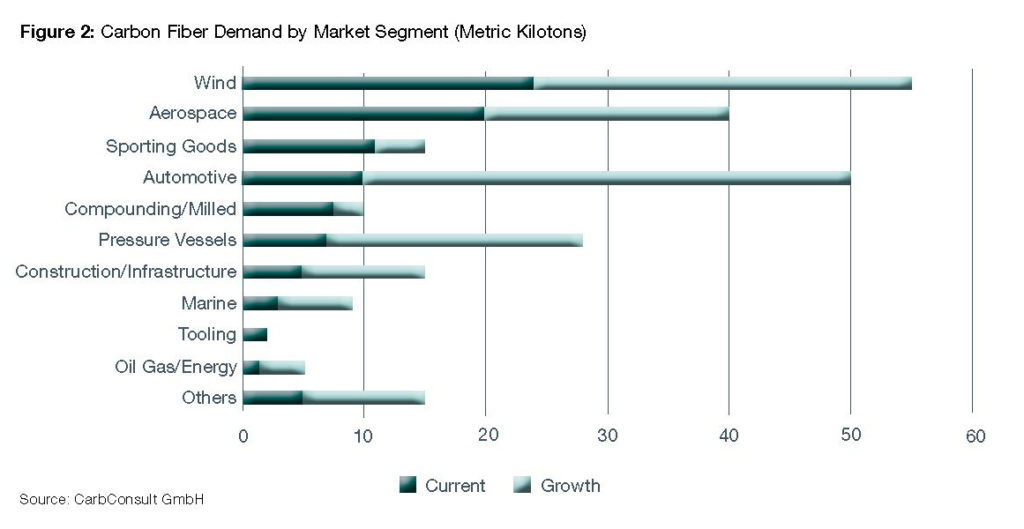

In 2019, demand for carbon fiber globally totaled approximately 100,000 metric tons. The market continues to grow at 10 to 12% per year, fueled by incremental volume gains in carbon fiber use in aerospace, wind turbine blades and several other industrial applications. Growth at this rate is likely to continue for the foreseeable future.

The approximate breakdown of carbon fiber use by market segment is as follows:

- Wind energy – 25%

- Aerospace – 20%

- Sporting goods – 10 to 12%

- Automotive – 10 to 12%

- Compounding for injection molded plastics – 5 to 8%

- Pressure vessels – 5 to 8%

- Construction and infrastructure – 5 to 8%

- Other market segments – 15%

All market segments show significant potential for growth as additional applications and new programs come into production.

To gain acceptance in any application, CFRP must demonstrate both technical and economic benefits. The main technical benefit of using carbon fiber for most applications is the material’s high strength-to-weight performance, which leads to lower weight, more efficient structures. For example, incorporating carbon fiber in wind turbine blades leads to lighter, more efficient aerodynamic shapes and blade designs. In automobiles, the weight of certain components and assemblies can be reduced by 50 to 75% when made of CFRP, thereby improving fuel consumption and CO2 performance or significantly extending the driving range of battery-powered electric vehicles. The future market segment scenario could look very different than today’s if development and adoption continue at the current pace. (See Figure 2.)

Another factor affecting the market is industry capacity for carbon fiber production, which is tightening. Nameplate capacity (the rated capacity) of carbon fiber producers added together may be 140,000 metric tons or more. However, considering the mix and variety of products produced and knock-down effects inherent in the process, effective industry net capacity is likely only around 110,000 metric tons. As a result, several new plants and capacity expansions have been announced from a variety of producers around the world, including North America (Mexico and the U.S.), Europe (Hungary and Turkey) and Asia (China).

For carbon fiber to gain a greater share of the overall composites market, volume is key. High-volume applications and broader adoption of CFRP require lower costs – both the cost of carbon fiber material and the manufacturing cost of making CFRP parts. Aircraft are built one per day, automobiles one per minute and wind turbine blades, sporting goods and other applications fall in between on the production volume scale. The issue of volume versus cost is a “chicken or egg” situation: Which comes first? However, we are confident that if industry professionals work together, then high-volume applications will materialize and result in the necessary lower costs and increased acceptance.

There are other issues, too. For instance, the challenge of unlocking mass adoption of CFRP in every day automobiles produced in the millions goes beyond pure technical and economic considerations. Sustainability and recycling also need to be addressed. But these issues are being tackled up and down the value chain.

In summary, the market for carbon fiber materials and CFRP end products is growing steadily and robustly. Demand has caught up to available capacity, and additional capacity has been announced and will come on stream in time. But, as always, the secret to continuing to unlock the potential demand for carbon fiber in all end-use applications remains using the right materials in the right ways. The future is promising for carbon fiber, and developments in the next couple of years will be interesting.

The Automotive Market

By Marc Benevento, President

Industrial Market Insight

Across the globe, light vehicles (gross vehicle weight rating under 8,500 pounds) consume roughly 5 billion pounds of composites on an annual basis. Thermoplastic matrix composites account for a majority of the volume. Composites and other lightweight materials have enjoyed strong growth recently, but the year ahead brings some headwinds for composites in automotive applications. The primary growth inhibitors will be a relatively flat market for light vehicles globally and a relaxation of fuel economy standards in the United States. However, opportunities for growth will exist as OEMs continue to reduce vehicle weight on global vehicle platforms.

Suppliers of automotive materials will need to gain market share to grow in 2020 because very little year-over-year production growth is expected. Europe is forecast to be flat, and a slight decline is anticipated in NAFTA as well. China is expecting low single-digit growth, which is very modest when compared to the phenomenal annual growth observed recently. Since the global production outlook is 2 to 3% per year through 2025, suppliers of composites will need to earn market share from incumbent materials in order to find meaningful growth.

In addition to general market sluggishness, relaxation of corporate average fuel economy standards in the United States will impact growth of composites in automotive. Weight reduction has been part of the OEM strategy to meet steadily increasing fuel economy and carbon dioxide emission regulations. These regulations have been the primary driver of the increased adoption of lightweight materials in automobiles over the past decade.

With the United States proposing to hold fuel economy regulations flat through 2026, OEMs will have less incentive to invest in weight-saving materials such as composites. This is particularly true for pickup trucks and large SUVs that are sold primarily in the United States. Suppliers of composites and other lightweight materials should expect less interest on U.S.-specific platforms given the current regulatory environment.

Rollbacks of fuel economy standards in the U.S. are only a minor setback to the adoption of lightweight materials on automobiles globally. More stringent regulation of carbon dioxide emissions outside of the U.S. will continue to drive the need for vehicle weight reduction on global vehicle platforms. Furthermore, weight reduction is critical to extend the range of battery-electric vehicles, and the pursuit of lightweight materials will continue for this small, but growing segment. Interest in composites for vehicle weight reduction will persist despite the “pause” on U.S. fuel economy regulations.

In order to capitalize on this interest, composite part suppliers will have to sharpen their value proposition versus alternative offerings. High-strength steel and aluminum have been the biggest beneficiaries of OEM weight reduction efforts in North America over the past decade, gaining 6% and 3% of vehicle mass, respectively. This share has been taken primarily from mild steel, which is the baseline automotive grade steel from the standpoint of cost, manufacturability and strength-to-weight ratio.

Normalizing the data and accounting for differences in specific gravity shows that the volume of high-strength steel and aluminum outgrew plastics and composite resins by factors of roughly 2 and 3, respectively, over this time period. Clearly, there is more work to be done if composites are to become the preferred option in mainstream automotive weight reduction efforts.

The near future will bring both challenges and opportunities for composites in automotive applications. Headwinds, including a relatively flat global production outlook and a decline in regulatory drivers for lightweight materials in North America, will present obstacles to growth. There will be continued demand for lightweight automotive materials, and suppliers of composite materials that can demonstrate cost-effective performance versus aluminum and other alternatives can position themselves to win new applications in a difficult environment.

The Aerospace Market

By Waruna Seneviratine, ATLAS Director