Although the aerospace news was discouraging, not all news in 2020 was bad. As we learned to stay at home, work from home and holiday near home, some markets did well. Demand for sporting goods jumped 30% to 40% in 2020, and installations of wind turbines continued as planned 20% higher than in the previous year.

The breakdown of carbon fiber use by end-use market in 2020 was roughly as follows:

- Wind energy – 23%

- Aerospace – 20%

- Sporting goods, including marine – 12%

- Automotive – 10%

- Pressure vessels – 10%

- Compounding for injection molded plastics and other short fiber applications – 8%

- Construction and infrastructure – 8%

- Other market segments – 9%

As in pre-COVID times, all market segments for carbon fiber have significant potential for growth as new applications and programs come into production. The underlying long-term megatrends that made carbon fiber attractive before COVID-19 remain unchanged. The advantages carbon fiber offers – stiffness, high strength-to-weight performance, corrosion resistance, electrical conductivity and others – are still valid today. For growth to occur, carbon fiber and CFRP parts must demonstrate both technical and economic benefits.

So we have a mixed bag of individual industries and applications driving overall demand for carbon fiber – some down, some up in these COVID times. Those segments that have contracted – especially aerospace – caused the total carbon fiber industry to look relatively flat in 2020, with only very modest growth expected for 2021. However, there is a more favorable long-term outlook. In a couple of years, one can reasonably expect to see a return to more robust year-on-year growth in the carbon fiber industry once again.

As for the industry’s capacity to produce carbon fiber, industry nameplate capacity of carbon fiber producers collectively is approximately 160,000 metric tons – more than enough to satisfy demand in current times. And several producers are planning additional new plants and capacity to satisfy increased future demand.

Finally, we must keep in mind that carbon fiber is still an industry in its early development phase. Aircraft are hand-built at a rate of just one or two per day; other applications slightly higher, but still without automation. Automobiles, on the other hand, are mass produced at rates exceeding one per minute. Today, carbon fiber is still used mostly in low-volume applications. It has not yet robustly demonstrated “mass production.” Surely this will come, but when is not certain.

In summary, COVID has dealt the carbon fiber industry a blow, but it will be temporary. Despite the events of this extraordinary year, the future is promising for carbon fiber, and developments in the next couple of years will be interesting.

The Aerospace Market

By Dr. Terrisa Duenas, Chief Technology Officer, Nanoventures

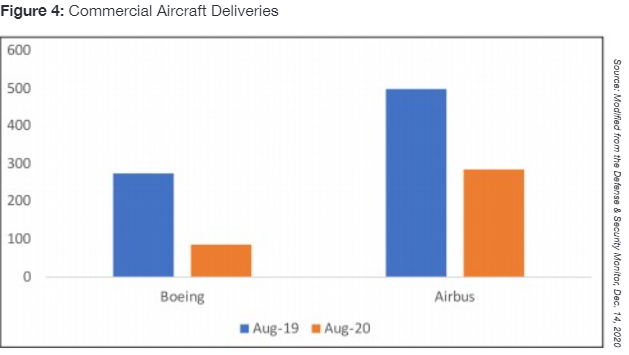

The aerospace industry has been affected dramatically by a confluence of events in the past couple of years, most notably the grounding of the Boeing 737 Max and the rise of the COVID-19 pandemic. On Nov. 18, 2020, FAA Administrator Steve Dickson rescinded the grounding order issued on March 13, 2019, of the Boeing 737 Max. But the intervening 18 months took a toll on the industry. In addition, both Boeing and Airbus had to temporarily close their facilities during the COVID-19 pandemic. As expected, both Boeing and Airbus struggle with significant cuts in production rates and lower orders. (See Figure 4.)

As the aerospace industry rebounds, technology solutions informed by innovation will be paramount to its success. Projects harnessing computer power continue to drive composite manufacturing in aerospace. These include integrated computational materials engineering (ICME), which can leverage the flow of data among disparate model frameworks; digital manufacturing, giving rise to digital twins; and the use of analytics to bridge the growing gap between 3D-printed parts and certifiable validation of their integrity.

With ICME, aerospace manufacturers see the significant benefits of agility within frameworks that encompass entire organizations, including their customers and stakeholders. A focus on the flow of data to link these frameworks provides both actionable information and performance metrics across silos that can be applied, in theory, at any level in the organization. With their growing complexity, these legacy companies also recognize the critical role of the small business “hard tech” startup often five to 15 years in advance of their impact. This is especially true for material providers, where heavy R&D is often subsidized by government investment in recognition of its pivotal value later.

Composites are the ideal material systems to both drive and add value to modeling, analytics or digital twin approaches where the complexity in components, additives and their morphology give rise to innumerable performance differences not only in the choice of constituents, but the manufacturing process as well. This value is especially true when computation can significantly reduce the time between customer requirements and FAA certification.

The crossroads of emerging technologies with United States modernization priorities have been in hypersonics, the off-planet economy (space) and cyber security. The latter provides ample challenges for the entire aerospace supply chain, not the least being the need to protect information. Beginning Nov. 30, 2020, the U.S. Department of Defense (DOD) introduced a self-assessment methodology requiring the DOD supply chain to quantify and report their current cybersecurity compliance. On the innovation side, government agencies continue to promote collaboration between startup technology developers and Tier 1 aerospace companies. One example is the Air Force’s AFWERX program, which facilitates connections across industry, academia and the military.

Critical to these emerging technologies are advancements in materials. The need for materials that survive in the harshest of environments between Mach 5 and Mach 20 in space have led to an increase in additively manufactured ceramic matrix composites research and investment. To gain a stronger foothold in aerospace, the composites industry can use lessons learned in polymeric and metal matrix composites to inform model-driven design of ceramic matrix composites using ICME workflows. Additionally, converting expert knowledge into basic two-by-two orthogonal designs of experiment that compare the legacy material within the same experiment will build confidence around using new composite materials and manufacturing approaches.

While baseline metrics have historically included high strength-to-weight ratios, corrosion and chemical resistance, the new off-planet space economy calls for survivability in extreme hot and cold temperatures. Volunteering to contribute to standard development, such as the work being done by the American Institute of Aeronautics and Astronautics (AIAA) Standards Steering Committee (SSC), will help to normalize testing and other activities among aerospace stakeholders.

In conclusion, the future of aerospace depends more than ever on its ability to innovate. That will require integrated development among government, primes, supply chains and startup stakeholders. Every stakeholder will play a significant role in balancing compliance and business model disruption to ensure a rebound.

The Construction/Infrastructure Market

By Ken Simonson, Chief Economist, Associated General Contractors of America

Most construction firms are glad to close the books on 2020. But there is plenty of uncertainty as to whether 2021 will present more opportunities or continuing hardship.

At first appearance, construction held up relatively well in 2020. The value of construction put in place, seasonally adjusted, was nearly identical in October and February, the Census Bureau reported on Dec. 1, 2020. But peel back the top layer from that onion and differences poke out. Residential construction spending – new single- and multifamily construction and improvements to owner-occupied homes – increased 7%, while private nonresidential spending slumped 6% and public spending on projects under way slipped 2%.

As public works that began long before the pandemic finish up, public spending is likely to decline much more in 2021. Private nonresidential construction also appears likely to shrink further, at least in the first half of the year.

All types of owners have experienced revenue losses that may leave them unable to afford, or qualify for, financing for construction – businesses that had planned to expand or modernize; investors and developers of income-producing property; universities and other nonprofits; and state and local governments. Some owners will have shut down permanently, while many more will find the demand for additional facilities has disappeared or, at best, become too uncertain to justify starting construction in 2021.

In the near term, only a few nonresidential niches look promising. These include renovations of many types of existing facilities to accommodate coronavirus-related requirements or where a new tenant or user type replaces one that closed. The demand for “last mile” or “last hour” distribution facilities close to residential customers will remain strong, as will demand for more data centers. More facilities will be needed for delivering medical care, screening and testing outside of hospitals and nursing homes. Selected manufacturers will want to add capacity to meet surging demand for certain products. And a jump in homebuilding, some of it in undeveloped areas, will trigger limited demand for related infrastructure, retail, consumer services and local public facilities.

Most infrastructure and public building construction will be constrained by the balanced-budget mandates for nearly all state and local government entities, declines in tax and user-charge revenues and unbudgeted expenses related to the pandemic. The outlook will brighten slightly for 2021 if the federal government enacts substantial funding explicitly for infrastructure or to backfill revenue losses incurred by state and local governments generally or specific highway, transit or airport agencies. However, the lengthy process of distributing funds to agencies; allowing time for design, bidding and contract award; and assembly of equipment, materials and workers by the winning bidder means that most of the spending would occur after 2021.

School construction may be a partial exception. Much of the funding comes from property taxes, which have not declined nearly as much as sales or income taxes, let alone transportation user fees. Unlike passengers or vehicles, there has been no decline in the number of pupils once they can safely return to schools. As more families relocate, demand will grow for both new and renovated or expanded schools.

The pandemic has added to demand for ways of replacing scarce, onsite, skilled labor. To the extent that composite materials and products enable substitution of offsite fabrication, or quicker installation by smaller or less skilled crews, there will be growing demand for composites, even if the products themselves cost more.

Thus, 2021 is likely to be a challenging year for contractors. But it may mark a turning point for composites manufacturers hoping to crack the construction market.