Overmolding could be one way of improving production speed and enhancing the properties of a thermoplastic composite part. Manufacturers heat an organosheet, which is a reinforced composite blank, and form a part in a press. The part is then injection molded as well. This process produces thermoplastic composite parts with complex geometries and integrated assemblies.

Hybrid additive manufacturing also has the potential for increasing production speeds. In this production method, manufacturers use 3D printing to add features to a larger substrate.

“By printing features like clips or retainers onto a larger substrate you can add complex functions to a simple part without the challenges of complex injection molding tooling,” explains Halsband. “Additionally, 3D printing features onto a larger substrate allows you to relatively easily utilize different resins on the same part. In one area you may need a stiff reinforcement rib or feature to secure a mechanical fastener, while in another area you may want to use a flexible material to mold clips to secure a wiring harness.”

With hybrid additive manufacturing it’s possible to produce relatively large parts with a mix of functional features. The process would simplify production and assembly through parts consolidation and optimized packaging.

Halsband believes that case studies demonstrating structural thermoplastics’ mass cost performance benefits will drive more opportunities. “Nothing beats the validation of success,” he says. “In the meantime, leading material, process and design firms must actively engage the market and share the successful development work that is ongoing now.”

Small Steps in Aerospace

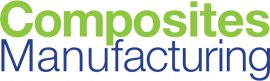

Thermoplastic composite manufacturer TxV Aero Composites, which is part of polymer provider Vitrex, and parts producer SFS Intec are working cooperatively to develop thermoplastic composite parts for the aerospace industry. They have re-engineered metal aircraft storage bin clip brackets and are using an overmolding process to produce a thermoplastic composite version using VICTREX AE™ 250 composites and VICTREX™ polyether ether ketone polymer.

The part is being produced using rapid manufacturing techniques that have reduced cycle time to minutes versus hours. An automated tape placement process produces the thermoplastic sheets tailored to meet the part’s requirements. The sheets are consolidated into laminates, press formed and machined into parts. Continuous fiber composite inserts are placed in an injection molding tool where a PEEK polymer is added. “This provides additional geometry and may functionalize that laminate in a way that cannot be done with composite material alone,” explains Jonathan Sourkes, TxV commercial manager.

The composite parts provide several advantages over the metal versions. They’re about 60% lighter, are faster to manufacture and don’t require the multiple milling steps needed for metal clips. Because there’s little waste, composite clips also have a much lower buy-to-fly ratio – the weight of the raw material divided by the finished component’s actual weight – than metal clips.

TxV started with semi-structural clips and brackets because the geometry is fairly simple and the isolated loads they carry aren’t flight critical. In addition, it’s easier to get small parts certified for aerospace use. But getting certification for clips or brackets is just a first step toward the goal of certification of larger, structural thermoplastic parts. “You have to find ways to get parts flying so you can demonstrate a track record of success in producing flightworthy parts and meeting application demands,” says Sourkes. At present, certification requires costly testing, but composites manufacturers are developing thermoplastic composite data for aerospace applications just as they are for automotive use. When new parts can be modeled, the need for physical testing will be reduced.

TxV creates digital twins of the parts it designs. “We have methods for parsing data and completing the analysis that get us to the point where we are comfortable that the part we will produce can be validated against those digital models,” says Sourkes. “We can analyze the digital models and be assured that our product is able to meet the qualifications and service requirements for the parts. It’s a much faster path to commercialization, and it allows the technology to proliferate.”

To reduce costs and cut the time between design and manufacture of thermoplastic composite components, designers are trying to get all the functional groups that will be working with a part involved at an early stage in the process, according to Sourkes. For example, looking at both performance and manufacturability at the initial stages will reduce the number of costly design and tool changes later. This can potentially take weeks, if not months or years, off the development process, he says.

Aerospace companies have additional reasons to take a closer look at thermoplastic composites, Sourkes adds. Because these components can be melted and reformed, airline companies may one day be able to recycle aircraft components that have reached their end of life.

Additional Applications

Although aerospace and automotive are leading the way in thermoplastic composites, other industries are discovering their potential. At the University of Alabama at Birmingham (UAB), Brian Pillay and his students have worked on thermoplastic composite projects for offshore drilling applications. One project involved the development of clamps to hold a new buoyancy system for deep water drills onto 350-plus drill strings, which are strong, heavy-walled pipes.

Having these parts made with composite materials was very important to the drill owner. “If for some reason the system failed, anything that was metallic would go down and damage the drill head, which costs tens of millions of dollars. It could also capsize the rig if the drill jammed,” explains Pillay. A composite piece, even if it fell, would not have that same impact.

Pillay initially tried to design the clamps with thermosets, but they couldn’t meet the project’s cost or strength requirements. With commercially available long-fiber nylon 66 glass and a nylon 66 thermoplastic resin, he and his students used extrusion compression molding to produce 750 thermoplastic composite clamps. Through extensive testing, these clamps proved they could meet every requirement.

Meanwhile, the thermoplastic composite nuts and bolts that a private company had made to hold the clamps in place didn’t fare as well and failed testing. Fortunately, the buoyancy project team, as a favor, had tested some thermoplastic nuts and bolts designed by one of Pillay’s PhD students. The hardware designed at UAB did meet requirements, so the team asked the university to produce 2,500 hardware sets in its full-scale prototyping lab. Those sets also performed well.

Clamped into place by thermoplastic composite parts, the buoyancy system was highly successful. “In fact, it did significantly better than they had anticipated, resulting in a $5 million savings for that exploratory drill operation,” Pillay adds.

The wind industry could be another market for thermoplastic composites. Giant wind blades are currently manufactured from cost-effective thermosets, but those blades are relatively brittle and tend to erode at the edges. With a thermoplastic leading edge on the blades, the industry could improve blade durability while retaining most of the economic advantages of thermosets.

Such examples are promising, but there are several technical and cost problems that need to be ironed out before there’s a smooth path to wider adoption of thermoplastic composites. The good news for now is that the thermoplastic composites industry is still in a pre-competitive phase. As people learn about the materials’ properties, most are willing to share what they know. While this period of cooperative research may not last, the information and insights gained will help encourage continued adoption of thermoplastic composite materials in aerospace, automotive and other industries.