As the new year began and the Omicron variant of COVID-19 led to a surge in cases, a sense of deja vu permeated the business landscape. But economists say there is reason for optimism in 2022. In its annual report condensing key viewpoints from dozens of investment outlooks, Bloomberg News forecast that the global economy will grow by 4.5% this year.

Composites Manufacturing magazine caught up with four consultants to shine a spotlight on three key market segments in the composites industry and provide predictions on glass and carbon fiber.

The Automotive Market

By Marc Benevento, President

Industrial Market

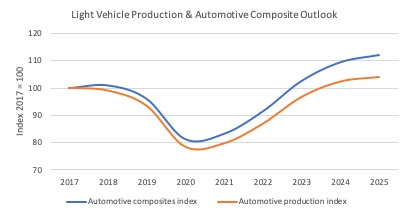

Last year will be remembered for the promise of a strong recovery of automotive production followed by the disappointment of supply chain disruptions that suppressed year-over-year growth. However, brighter days are ahead for suppliers to the industry as production is expected to recover to pre-pandemic levels over the next 24 months. Furthermore, the continued shift toward electric vehicles will favor increasing use of composite materials in the automotive industry.

The global market for light vehicle composite materials was 3.7 billion pounds in 2021, far short of where it was just a few years ago. Global light vehicle production plummeted 16% in 2020 due to COVID-19 shutdowns, and demand recovered more quickly than a stressed supply chain could support. After a strong start to 2021, global production gained a paltry 2% over a disastrous 2020, leaving automotive composites consumption 20% below the pre-pandemic level.

Despite the difficulties of the past two years, better times are ahead for suppliers of automotive composites. Demand for automobiles remains strong, particularly in North America. Supply chain constraints are expected to ease over the course of 2022, and production should return to pre-pandemic levels by late 2023 or early 2024. Suppliers that have weathered the storms of the past two years have reason to hope that the next two years will present a more hospitable business environment, with 8 to 10% annual volume growth expected in that timeframe.

In addition to the tailwind of market recovery, composites continue to win automotive applications based on the value they provide carmakers in terms of cost, weight and performance. Electric vehicles are particularly well suited to composites due to their low under hood temperatures and the position they currently occupy in the market, which will expand the available market for manufacturers of composite materials in automobiles.

Elimination of the internal combustion engine and exhaust system will significantly lower the operating temperature requirement of many automotive parts, creating new opportunities for composites. Battery covers and enclosures are a perfect fit for composites due to their high strength-to-weight ratio, corrosion resistance, design flexibility and part consolidation opportunities versus stamped metal assemblies. Challenging new fire-resistance standards for electric vehicle components can be met with the selection of an appropriate resin system or with the addition of intumescent coatings.

The current market position of electric vehicles also favors growth of composite materials. Because today’s batteries cost more than an equivalent gasoline engine, electric vehicles occupy a premium position in the market. The high selling price of these vehicles limits sales volume, however, which generally favors composites. As production volume decreases, the fixed cost of dies for steel or aluminum stampings becomes a larger part of the unit part cost, which improves the economics of composites for applications such as closure panels and truck beds. This trend will continue for at least the first half of the decade, after which battery costs are expected to be nearly on par with internal combustion engines.

The growth trajectory of automotive composites is illustrated by indexing vehicle production and automotive composites volume to a base year of 2017 and projecting demand through 2025. Should composites continue to grow above the market, as they have for the past decade, automotive composite volume will eclipse the base year a full year earlier than light vehicle production.

Figure X: Light Vehicle Production & Automotive Composite Outlook

Source: Industrial Market Insight

The Glass Fiber Market

By Dr. Sanjay Mazumdar, CEO

Lucintel

More than two years since the COVID-19 outbreak, the pandemic’s effect lingers on manufacturing operations across industries. The entire supply chain has been disrupted, and the glass fiber industry is no exception. Factors including shipping delays, increases in ocean freight and container cost, decreased Chinese exports and customer demand have led to shortages of composite raw materials, such as glass fiber and epoxy and polyester resin in North America.

Even with supply chain issues, the U.S. glass fiber market grew 10.8% in 2021, with demand increasing to 2.7 billion pounds compared to 2.5 billion pounds in 2020. Construction, pipe and tank, electrical and electronics, wind energy, consumer goods and marine applications experienced significant growth, while the aerospace market declined in 2021.

The U.S. glass fiber industry benefitted considerably from growth in the wind energy industry in 2021 due to a rush to get construction started in time to qualify for the production tax credit (PTC) before its expiration at the end of the year. As part of the COVID relief packages, the U.S. government extended the PTC to 60% of the full credit amount for wind projects that began construction by Dec. 31, 2021. Lucintel estimated 8% growth in the U.S. wind energy market in 2021 after double digit growth in 2020.

The marine market also grew during the pandemic as consumers sought safe, socially distanced leisure activities in the outdoors. The U.S. glass fiber market for marine was estimated to grow by 18% in 2021.

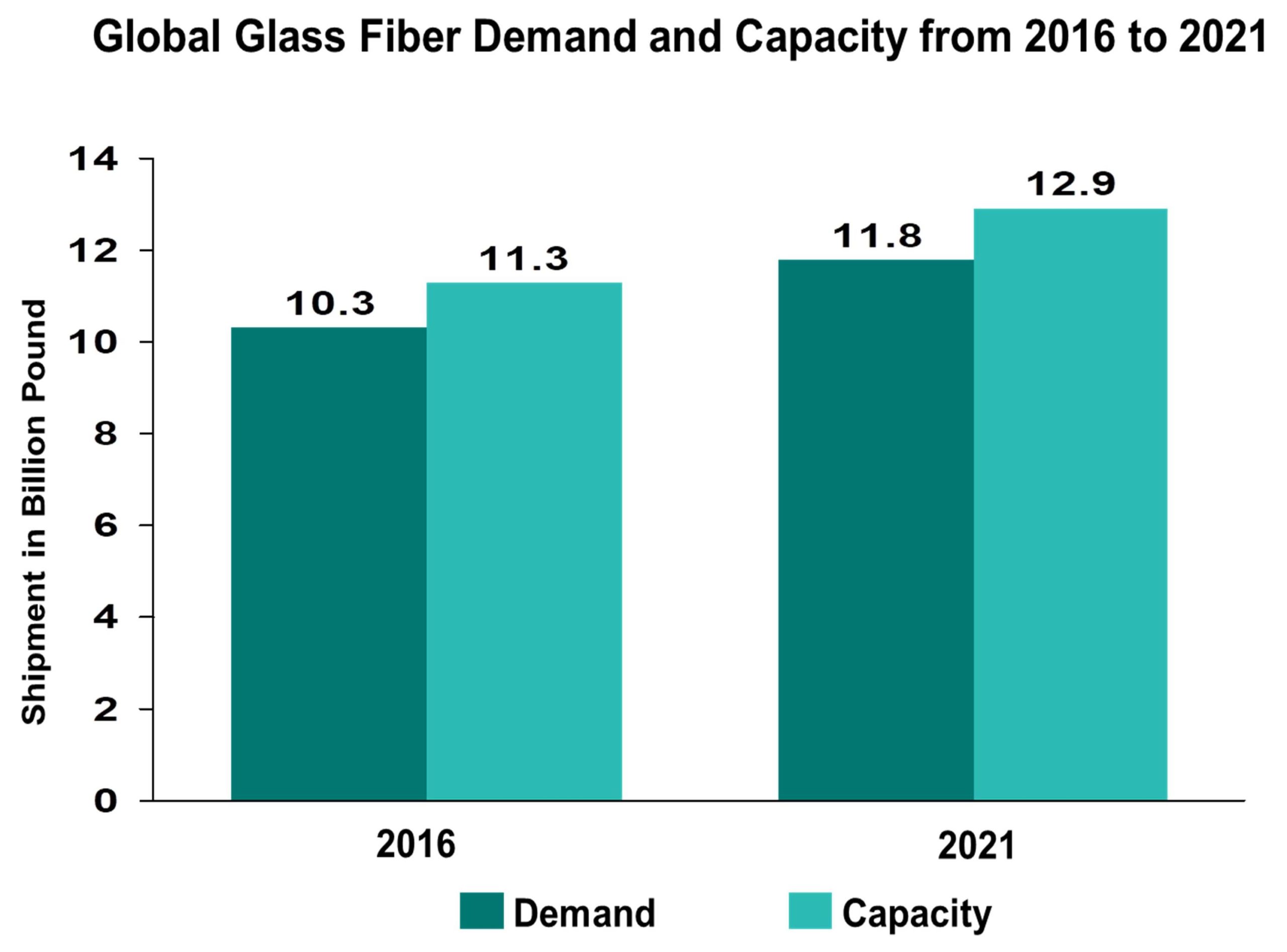

In terms of supply and demand dynamics in the glass fiber industry, the utilization rate increased to 91% in 2021 from 85% in 2020 due to growth in consumption of glass fiber in all end use industries. The global glass fiber capacity was 12.9 billion pounds in 2021. Lucintel predicts that the fiberglass plant capacity utilization rate in 2022 will reach 95%.

In the next 15 to 20 years, there will be substantial innovation in the glass fiber industry, particularly in the development of high-strength and high-modulus glass fiber, which competes with other high-performance fibers like carbon fiber. Two mega trends across market segments that will lead to further innovations are light-weighting and carbon dioxide reduction.

For example, light weight solutions are increasingly important in the wind energy market thanks to the rising number of offshore wind turbines, repowering of old turbines and growing installations with high turbine capacity in locations that receive high-speed wind. Throughout the market, the average size of wind turbines continues to grow, which results in a need for larger and stronger blades. This, in turn, creates demand for lighter, stronger material. Several companies, including Owens Corning and Jushi, have developed high-modulus glass fiber to meet market demand.

While GFRP composites are a staple in the marine industry, new technologies are changing the face of this market. Moi Composites, which developed an advanced 3D technology, has produced the MAMBO (Motor Additive Manufacturing Boat). The 3D-printed 6.5-meter power boat, made from continuous glass fiber-reinforced thermoset composites, has no hull-deck division and employs concave and convex shapes not possible with traditional composite fabrication. The marine industry has also taken steps toward greater sustainability. RS Electric Boats developed the first all-electric rigid inflatable boat (RIB) incorporating fiberglass and recycled carbon fiber in major structural components.

In conclusion, the use of glass fiber in various industries is expected to recover from the deleterious effects of the pandemic. Transportation, construction, pipe and tank, and the marine market in particular will play a major role in helping the U.S. market grow back to pre-pandemic conditions. Overall, the U.S. glass fiber market is expected to witness strong growth in 2022 and fully recover from the fallout caused by the pandemic.

Figure X: Global Glass Fiber Demand and Capacity

Source: Lucintel

The Aerospace Market

By Richard Aboulafia, Managing Director

AeroDynamic Advisory

The aircraft industry was hit by the COVID-19 pandemic as hard as any industry. World aircraft deliveries fell 35% in 2020 from 2019, while world air travel demand fell 66%. The industry hadn’t seen anything like these numbers since the jet age began.

Yet there are reasons for cautious optimism. According to preliminary year-end numbers, the industry grew 7.5% in 2021. And 2022 should see a very strong 22% expansion.

Military deliveries were hit last year solely for logistical reasons, including pandemic-related factory closures and supply chain disruptions. Actual demand wasn’t hit at all. Countries that initially announced pandemic-related defense budget cuts, such as South Korea, reversed those plans and increased spending over the previous year.

Domestic and export defense demand has been strong, both for geopolitical reasons and because defense spending is viewed as a good way for governments to support national aerospace industries and national economies in a very difficult time. Military output will fully recover to pre-pandemic levels in 2022, with additional strong growth after that.

Business aircraft have also come back fast, with utilization recently passing 2019 peak levels. Corporate profits, equities markets and oil prices – the three big drivers behind demand – are all at very high levels, coupled with strong interest in avoiding the service cutbacks and high load factors of airline transport. Delivery numbers are recovering accordingly, and we will see a return to 2019 peak levels there (in units) next year.

Jetliners – normally accounting for around 60% of total industry output – are overall in good shape. We’re expecting air traffic to return to its 2019 peak in early 2023. Fuel prices are back from record lows to a high $80/barrel level, while jetliner financing costs remain quite low. This ratio – the cost of fuel to the cost of capital – is the most important determinant of jetliner market health after airline traffic. The market does best when expensive (but not too expensive) fuel provides an incentive to replace older jets and when there’s inexpensive financing available for those new jets. Right now, the ratio looks excellent.