Companies that buckle up for a bumpy ride may cross the finish line in good positions.

At first glance, the outlook for 2023 may appear bleak. Many economists envision a downturn in global gross domestic product accompanied by recessions in the United States and Europe. The Federal Reserve predicts a larger hike in interest rates this year than initially planned. In addition, the war between Russia and Ukraine, as well as China abandoning its zero-COVID policies, create uncertainties in the market. However, it’s not all doom-and-gloom for the composites industry.

Composites Manufacturing magazine asked consultants to share their outlook for composite materials and end-use products this year and beyond. It’s a mixed bag, but there’s reason for optimism.

The Aerospace Market

By Richard Aboulafia, Managing Director

AeroDynamic Advisory

Aerospace markets are mostly in very positive territory. That’s the good news. The bad news is that because of supply chain disruptions, industry output has become de-linked from market health. The deliveries recovery is much slower than hoped as a result.

First, markets. Thanks to Russia’s war on Ukraine and ongoing tensions in the Western Pacific, global defense spending is at a high, exceeding $2 trillion worldwide for the first time in 2021. We see it growing at about 5% per year, although inflation complicates buying power. Combat aircraft markets are in particularly good shape, as major powers need to re-equip their militaries to deal with peer adversaries, rather than counter-insurgency operations and low intensity warfare.

Single aisle commercial jets are the biggest civil segment, and demand is quite strong. These jets primarily serve domestic markets, which, outside of China, have come back to 2019 levels. Domestic routes are a commodity service, where airlines basically have minimal pricing power. Domestic service economics, therefore, depend on cost control. When fuel is $100/barrel, if one airline has an Airbus A320Neo or a Boeing 737 MAX and its competitor does not, then the airline with the modern jet can both out-price and out-profit the competition. Thus, single aisles are also benefiting from relatively high fuel prices.

Most other civil segments are quite strong, too. Business jet utilization has been very strong, and used jet availability very low. Backlogs are quite high. Indicators are above 2019 levels, and output is roughly there, too.

The only aerospace market that can be termed weak is twin aisle jetliners. The COVID-19 pandemic hit international traffic first, most and longest. This created a terrible twin aisle overcapacity situation. The growing role of third-party finance made the problem worse for twin aisles, because lessors and other financiers simply prefer to finance single aisles, due primarily to their much larger client base. Meanwhile, the increasing capabilities of new single aisle jets – again, the A320neo and 737 MAX – make them appealing replacements for twin aisles on medium haul international routes, particularly across the Atlantic.

Unfortunately, these twin aisle jetliners are the most composite-intensive civil aircraft, so the composites industry is particularly dependent on military aircraft output. Here, the F-35 continues its slow production ramp and should hit a level of 156 jets per year in the next few years. It will be followed by Northrop’s B-21 Raider stealth bomber, just about to enter production, and the Air Force’s Next Generation Air Dominance combat aircraft program, which should enter production by the end of the decade.

But again, with all of these civil and military programs, for all markets, production output goals are not being met. The problem is worst in the jet engine production system, where castings and forgings represent a significant bottleneck. Many of these are titanium, and the disruption of Russian titanium supplies due to the war – voluntary on the part of Western companies, as Russia hasn’t moved to block exports – has worsened pre-existing supply problems.

Much of the problem comes down to labor. A tight labor market, coupled with the fact that we’ve just been through the first economic recovery to see commercial aviation relatively late compared with other sectors – and therefore late to hire people – has resulted in major delays.

Civil and military aero markets remain strong, and production delays have enforced a kind of discipline on jet manufacturers. Thus, there’s a very good chance that this sector of the economy benefits from a cooling down in other sectors, lowering producer costs and freeing up labor. This implies a relatively benign 18 to 24 months ahead, with respectable growth and lower inflation.

Figure 1: Top Five Aerospace Platforms, Cumulative Deliveries Value

Source: AeroDynamic Advisory

The Glass Fiber Market

By Dr. Sanjay Mazumdar, CEO

Lucintel

Last year was a tale of two halves in the North American composites industry. The industry showed robust growth at the outset of 2022, with January demand up by 5% and February demand up by 10% from a year earlier. Slight improvements in distribution helped to keep performance high, though raw materials and transportation of finished goods remained the biggest challenges in reaching full market demand in the beginning of the year. Marine, construction and infrastructure all performed quite well, and no industry performed particularly poorly in the beginning of 2022.

Conversely, in the second half of the year, the composites market was flat to nearly 7% down in most months compared to a year earlier due to a softening in recreational vehicles, buses, trucks, housing-related products, marine and other sectors. Another factor for decreasing demand in the second half of the year was rising interest rates by the Federal Reserve, which increased interest rates four times in 2022 in an effort to control inflation. So, the significant gains in the first half of the year were washed away in the second half.

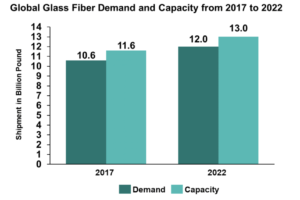

Overall, the global glass fiber market grew about 2% in 2022, with demand increasing to 12 billion pounds compared to 11.8 billion pounds in 2021. Most of the major sectors, including construction, electrical and electronics, and automotive grew in 2022.

Global glass fiber capacity reached 13 billion pounds in 2022 from 11.6 billion pounds in 2017, and demand for glass fiber increased from 10.6 billion pounds in 2017 to 12 billion pounds in 2022. The glass fiber plant capacity utilization rate increased from 90% in 2021 to approximately 92% in 2022.

In the future, demand for glass fiber will remain robust, with increasing demand in wind energy, electrical and electronics, automotive, marine and construction. However, there is the possibility of a mild recession in the beginning of 2023 as the Federal Reserve seeks to keep interest rates high this year to control inflation. The main variables are how long inflation will continue and how it will impact investment and consumer behavior.

One of the major challenges that has plagued the composites industry during the past two years is increasing raw materials prices. There are many factors impacting the record-high price increases in fibers and resins, such as post-pandemic consumer demand, increased fuel prices, ongoing supply chain issues, geopolitical events and the war in Ukraine.

Lucintel’s quarterly pricing study suggests that prices for most of the major resins – such as unsaturated polyester resin and epoxy – and major fibers – such as glass fiber and carbon fiber – went up between 20 and 80% in 2021. In terms of competing materials, steel and rebar prices increased 30% to 35% in 2021, and aluminum prices increased 60% in 2021. The good news is that in the second half of 2022, raw material prices started stabilizing or even softened as a result of softening of demands.

Figure 2: Global Glass Fiber Demand and Capacity

Source: Lucintel

The Automotive Market

By Marc Benevento, President

Industrial Market Insight

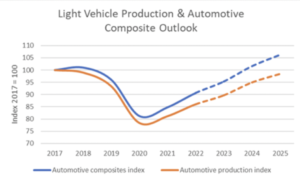

Last year brought an uneven recovery of global light vehicle production, with a 6% year-over-year gain in production that provided suppliers of automotive composites some breathing room while leaving plenty of headspace for future growth. Demand for automotive composites returned commensurately with production, and the need to reduce weight to improve fuel efficiency of internal combustion engines (ICE) and range of battery electric vehicles (BEVs) provides promise for new applications that will drive above-market growth in the future.

The global market for light vehicle composite materials grew to 4 billion pounds in 2022. Although this was nearly a 7% increase from 2021, it remains 10% below the level reached in 2018 due to the significant decline in global vehicle production during the COVID-19 pandemic and semiconductor supply chain disruptions that have delayed market recovery. Global geopolitical issues, such as Russia’s invasion of Ukraine, Brexit and work stoppages in China due to the country’s zero-COVID policy, further complicated matters and led to a very uneven volume recovery in major global production centers.

In 2022, light vehicle production growth, and therefore automotive composites growth, was strongest in North America, which saw a 12% increase in vehicle production. China’s production grew 6%, which, due to the number of vehicles produced there, contributed nearly equally to incremental volume growth. Production volume in Europe declined slightly and rose only slightly in Asia outside of China, resulting in 6% growth of global vehicle production, which was slightly outpaced by growth in automotive composites.