The U.S. economy did better than expected in 2023, avoiding a recession that many experts predicted. Inflation fell, jobs increased and manufacturing investments spiked. But if there’s a theme for 2024 it might be uncertainty due to several factors, including higher interest rates, sluggish global supply chain restructuring, and wars and political uncertainty throughout the world.

In this year’s State of the Industry report – one of Composites Manufacturing magazine’s most anticipated articles each year – four experts provide insight on markets and materials to help guide composites companies through the uncertainty.

The Automotive Market

By Marc Benevento, President

Industrial Market Insight

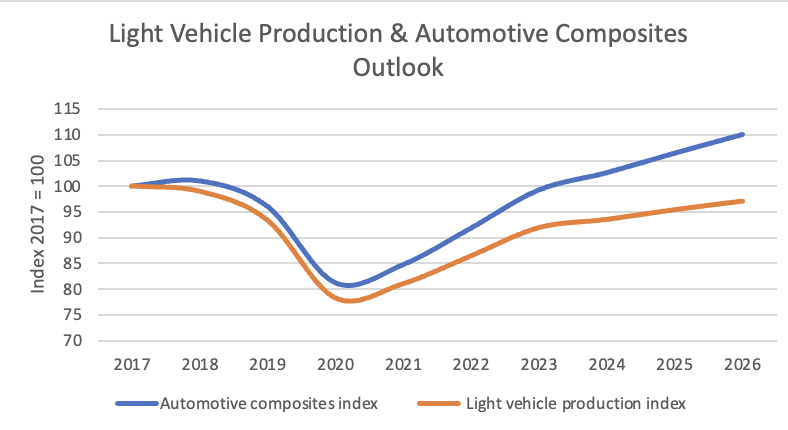

Last year brought continued recovery to the automobile supply chain, with global vehicle production improving by 6% year-over-year and returning to near pre-pandemic levels. Demand for automotive composites outpaced vehicle production, as composites continued to win applications and increase their share of vehicle composition. Weight reduction will continue to be of paramount importance in improving the fuel efficiency of internal combustion engines (ICE) and hybrid vehicles, while also helping to maximize the range of battery electric vehicles (BEVs). Composite materials promise to deliver new applications that will drive above-market growth in the years to come.

The global market for light vehicle composite materials grew to nearly 4.4 billion pounds in 2023, roughly on par with the pre-pandemic peak in 2018. Although global light vehicle production remains 8% below pre-pandemic levels, the more rapid recovery of light vehicle composite volume can be attributed to a gain in market share versus competing materials such as steel and aluminum.

In 2023, light vehicle production growth was uneven regionally, with Europe well above the global average growth rate, China well below average and other major regions generally aligned with the global average of 6% growth. With global supply now relatively aligned with demand, vehicle production growth will flatten, and suppliers will lose the tailwind they have enjoyed for the past few years. The outlook for light vehicle production growth over the next few years is less than 2% per year, making volume growth more difficult for suppliers to achieve. However, the adoption of composite materials is occurring at an accelerating pace which will help counter that trend.

The automobile industry remains in a transitional state, with BEVs rapidly gaining market share due to government incentives and global efforts to reduce greenhouse gas emissions. However, ICE and hybrids still account for 80% of global vehicle sales. China is leading the BEV charge, accounting for almost 60% of global BEV sales, and Europe adds another 20%. Although BEV sales have reached record levels in the United States, mainstream consumers are more frequently opting for hybrid vehicles, which offer improved fuel economy without the range anxiety associated with reliance on the developing EV charging network. North America will continue to lag in the global adoption of BEVs.

The good news for suppliers of automotive composites is that, regardless of powertrain type –BEV, hybrid or ICE – OEMs are aggressively pursuing weight reduction to improve fuel economy or increase the range of BEVs. The need for weight reduction has resulted in above-market growth for both thermoplastic and thermoset composites. Applications such as liftgates and seat frames, which take advantage of the design flexibility that composites offer to eliminate parts and streamline manufacturing while reducing weight, can also add new or improved function for users. The multi-functional benefits offered by composites will accelerate their use in light vehicles over the next decade.

With the global automotive supply chain largely back to normal, light vehicle production has recovered to pre-pandemic levels and production growth will flatten in the near-term future. However, composites will deliver above-market growth by winning new applications due to their ability to reduce vehicle weight, minimize complexity and deliver unique packing and function to end users when properly incorporated into light vehicle design.

Figure 1: Light Vehicle Production & Automotive Composites Outlook

Source: Industrial Market Insight

The Glass Fiber Market

By Dr. Sanjay Mazumdar, CEO

Lucintel

Last year, the overall glass fiber market sentiment remained cautious, underscoring persistent economic uncertainties in the U.S. The looming prospect of a recession added complexity, with potential consequences including workforce layoffs and increased challenges in the housing and other markets. Broader economic factors, such as inflation, interest rates and discretionary spending, are also influencing demand for products such as boats and recreational vehicles. In addition, the recent increase in interest rates has softened discretionary spending, directly impacting home sales and construction demand.

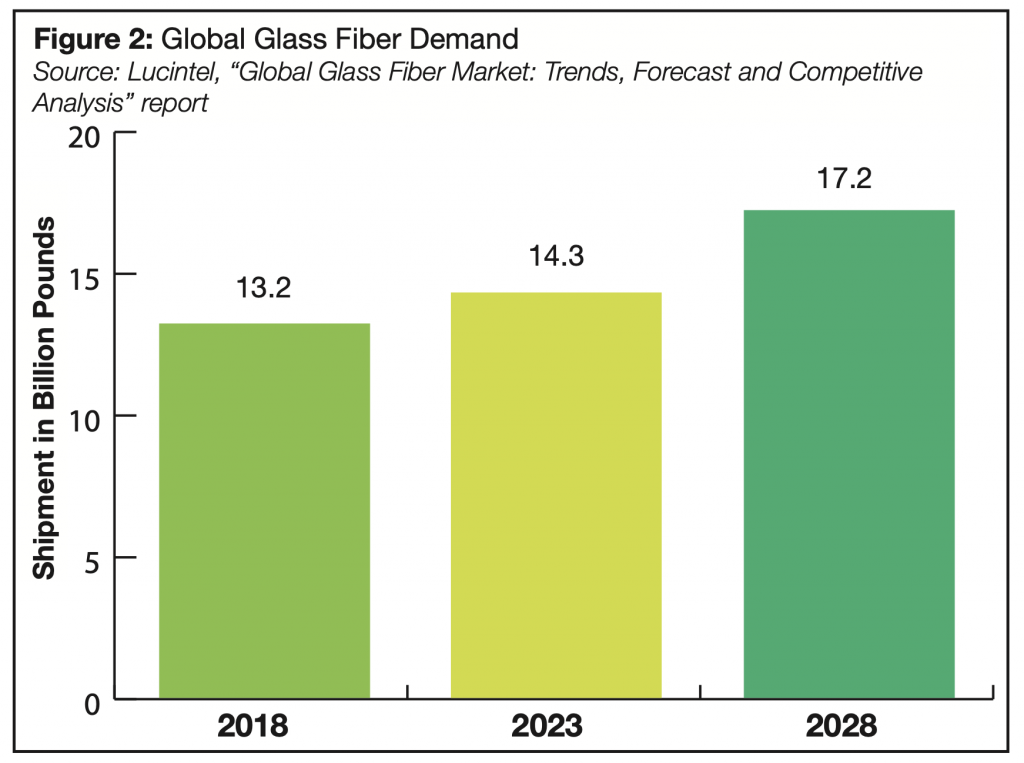

Overall, demand in the glass fiber market reached 14.3 billion pounds in volume in 2023. The future seems to hinge on navigating these complex market dynamics and adapting to the shifting economic landscape.

There is a possibility of interest rate cuts in Q1 or Q2 2024 in the U.S., which will positively impact investment and consumer behavior. Lucintel forecasts that glass fiber demand will increase by approximately 4% at a compound annual growth rate (CAGR) in terms of volume from 2023 to 2028 as shown in Figure 2.

One of the major challenges that plagued the composites industry in 2021 and 2022 was increasing raw materials prices due to supply chain issues, geopolitical events and the war in Ukraine. Resin and fiber prices declined in 2023 due to softening of the economy.

In the future, demand for glass fiber will remain robust, with increasing demand in wind energy, electrical and electronics, automotive, marine and construction. According to the U.S. Department of Energy (DOE), wind energy accounted for 22% of all new electricity capacity installed in the United States in 2022. Wind energy is poised for rapid growth, attracting $12 billion in capital investment in 2022, according to the DOE. The forecasts for land-based wind energy installed in 2026 will increase nearly 60% from approximately 11,500 megawatts (MW) to 18,000 MW in the U.S. since the Inflation Reduction Act passed. This will drive consumption of glass fiber composites in the U.S.

As environmental consciousness grows, the glass fiber market’s shift toward sustainability is a win for consumers who prioritize eco-friendly choices. Recyclable and low-impact glass fiber products contribute to a greener future. However, big questions loom over how to handle the waste these materials create. For instance, while most parts in wind turbines are recyclable, turbine blades present a challenge – the bigger the blades, the bigger the problem of waste management.

The sustainable solution seems to be using recycled material and recycling waste. Major OEMs are collaborating with partners to experiment with recycling processes. For example,

GE produced the world’s first prototype of a fully recyclable wind turbine blade, a new step toward the industry’s transition to a circular economy under the Zero Waste Blade Research (ZEBRA) consortium, which includes Arkema, CANOE, Engie, LM Wind Power, Owens Corning and SUEZ. The 62-meter blade is made with Arkema’s 100% recyclable Elium® liquid thermoplastic resin and high-performance glass fabrics from Owens Corning.

Several glass fiber suppliers also have an eye on sustainability. China Jushi plans to invest $812 million to build the world’s first zero-carbon glass fiber plant in Huai’an, China. Toray Industries developed a technology to recycle glass fiber-reinforced polyphenylene sulfide (GFRP-PPS) that performs like virgin resins. The company leverages a proprietary compounding technology to blend PPS resin with special reinforcing fibers.

Overall, the glass fiber market is undergoing a remarkable transformation, driven by growth, innovation and a heightened awareness of sustainability. The global glass fiber industry is expected to grow in the coming years. Key factors driving growth include increased demand from emerging economies, further adoption in transportation and construction sectors, and new applications in emerging industries.

Figure 2: Global Glass Fiber Demand

Source: Lucintel, “Global Glass Fiber Market: Trends, Forecast and Competitive Analysis” report

The Aerospace Market

By Richard Aboulafia, Managing Director

AeroDynamic Advisory

Much of the world economy is facing a highly unusual situation. For the first time since the 1960s, the defining problem is not inadequate demand, but inadequate supply. Whether it’s cars, houses or aircraft, output is increasingly determined by production limitations.

This is particularly true for aviation. Demand is strong enough to justify faster growth, but supply chain delays, final assembly line stumbles and other production problems are suppressing output.

First, on the demand side, the Russia-Ukraine war, tensions in the Western Pacific and the Israel-Hamas war have pushed defense spending into record territory. The U.S. has been spending at record levels for years. In fiscal 2024, the defense budget request includes $315 billion for weapons investment, including procurement, as well as research and development.

On the civil side of the industry, air travel demand has almost completely recovered from the COVID-19 pandemic. Demand for new jetliners remains quite strong. Backlogs are near record highs, and the ratio of new orders to completed sales has been above 1:1 for two years. Business jet demand is also strong, correlating with robust corporate profits, equities markets and oil prices.

Yet despite these powerful market drivers, aircraft industry output remains feeble. Military output is flat, although much of that is due to a deliveries hiatus for the Lockheed Martin F-35 Joint Strike Fighter, the world’s largest defense program. Civil output grew approximately 20% last year, but much of the growth came from delayed deliveries of jets built in previous years – Boeing 737 MAXs and 787 Dreamliners. In all, aircraft production, net of already-built jets, was anticipated to grow less than 10% in 2023.

How long will this unusual situation continue, with demand strongly outpacing supply? On the defense side, it will persist for the foreseeable future. After a multi-decade, post-Cold War hiatus, global tensions are high and it’s unrealistic to think they will ameliorate. Militaries around the world are expanding and replacing old, worn-out equipment. They are also eager to adapt new technology – particularly for surveillance, reconnaissance and battlefield management – but also to rebuild depleted weapons inventories.