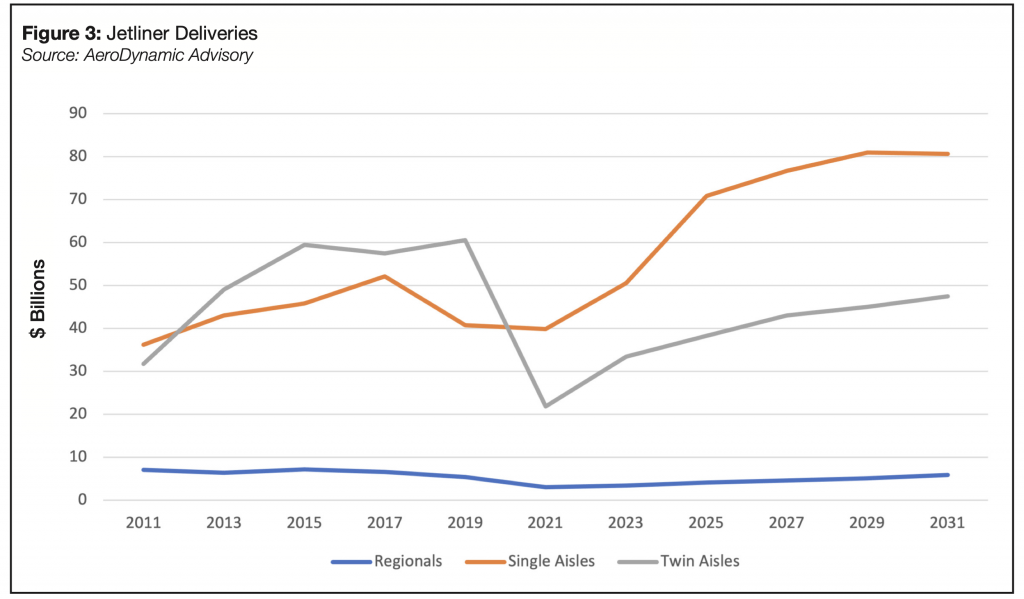

The commercial side is more difficult to predict. However, given that airlines and other customers are eagerly awaiting jets on back order and that travel demand drivers remain solid, it will likely be at least two to three years before we need to worry about the usual market indicators again, such as passenger traffic and airline profitability.

On the downside, there is the risk of another exogenous shock, such as another pandemic. However, there is potential upside, too: China demand growth has stumbled, but it could resume its strong historic pace.

A final note on the aerospace industry’s recovery. Historically, the industry recovers from downturns at a brisk pace, burning through backlogged orders and swiftly bringing in revenue. Typical recoveries see higher annual growth rates than today’s, but they are often followed by a downturn frequently self-induced by overproduction. The silver lining is that production constraints appear likely to prevent this kind of overproduction. The industry might just have a smooth, steady decade of growth ahead.

Figure 3: Jetliner Deliveries

Source: AeroDynamic Advisory

The Carbon Fiber Market

By Dr. Sanjay Mazumdar, CEO

Lucintel

Last year was challenging for the carbon fiber industry in non-aerospace applications due to high interest rates and lower demand. The global carbon fiber industry reached 280 million pounds ($3.2 billion) in volume in 2023. However, Lucintel forecasts that demand will increase at a compound annual growth rate (CAGR) of approximately 8% in volume from 2023 to 2028 due to growth of carbon fiber in wind turbine blades, a resurgence in aircraft deliveries, light vehicle production and demand for sporting goods, recreational vehicles, and electrical and electronic products.

One area that offers significant opportunities for carbon fiber is prepreg materials. Lucintel expects the global prepreg market to reach an estimated $8.4 billion by 2030 with a CAGR of 5.5% from 2023 to 2030. Much of this growth will be driven by increased demand from the automotive, aerospace, defense and renewable energy industries.

Carbon fiber use in the aerospace industry is gaining momentum as OEMs continue to benefit from post-pandemic travel recovery. Lucintel expects carbon fiber use in the aerospace and defense market to grow at a CAGR of 7.3% from 2023 to 2030 in part due to increased demand for lightweight aircraft and expansion of aircraft with high carbon fiber penetration, such as the Boeing 787 Dreamliner, the Airbus A350XWB and the Airbus A380.

Carbon fiber manufacturers are investing in new or upgraded facilities to meet increasing demand. Toray Composite Materials expanded its facility in Decatur, Ala., with an investment of $15 million. The company allocated internal capital to double the production capacity of TORAYCA® T1100 intermediate modulus plus (IM+) carbon fiber and add critical redundancy.

In addition to traditional markets like aerospace, emerging markets also offer opportunities, including pressure vessels for hydrogen storage and the advanced air mobility market. While these markets are in their nascent stages, the potential impact on the carbon fiber supply chain cannot be understated. As these markets mature, the demand for carbon fiber is expected to grow further.

While opportunities abound, there are a few major challenges facing the carbon fiber industry. Key among them is the quest for sustainability. OEMs and Tier 1 suppliers are aggressively pushing their carbon fiber suppliers to provide sustainable carbon fiber.

Most OEMs have set targets to become carbon neutral by 2050. They have begun considering recycling as part of their design criteria for the next generation of parts manufacturing. Several carbon fiber companies are investing in bio-based PAN precursors to produce carbon fiber. Toray is working to move to a bio-based PAN precursor, while other companies, such as Hyosung, have started using bio-based PAN precursor on a trial basis.

Carbon fiber is an energy-intensive manufacturing industry. Most players are striving to decrease CO2 emissions from carbon fiber production by switching to renewable energy. Since energy cost is a sizeable portion of carbon fiber production, companies are focusing on utilizing wind and solar energy. SGL Carbon plans to utilize 100% renewable energy for carbon fiber production soon, and Zoltek has started using renewable energy in some of its plants.

Another obstacle to wider spread adoption of CFRP is the high cost of manufacturing carbon fiber. Ongoing price wars from Chinese carbon fiber manufacturers will further disrupt the market. While Chinese players are rapidly adding new capacities, there is mounting pressure on the profitability of manufacturers.

Zhongfu Shenying Carbon Fiber Co. plans to invest $866 million in a new plant in Lianyungang, China, to produce 30,000 tons of high-performance carbon fiber a year. Construction began in April 2023 and will be completed in August 2026. Lucintel anticipates that new capacity such as this will contribute to significant price competition in carbon fiber in the coming years, and the price of carbon fiber will fall in many applications.

Overall, manufacturers need to focus on innovation to reduce costs while developing new and low-cost technology to meet the industry demand and make carbon fiber more accessible.

The Construction/Infrastructure Market

By Ken Simonson, Chief Economist

Associated General Contractors of America

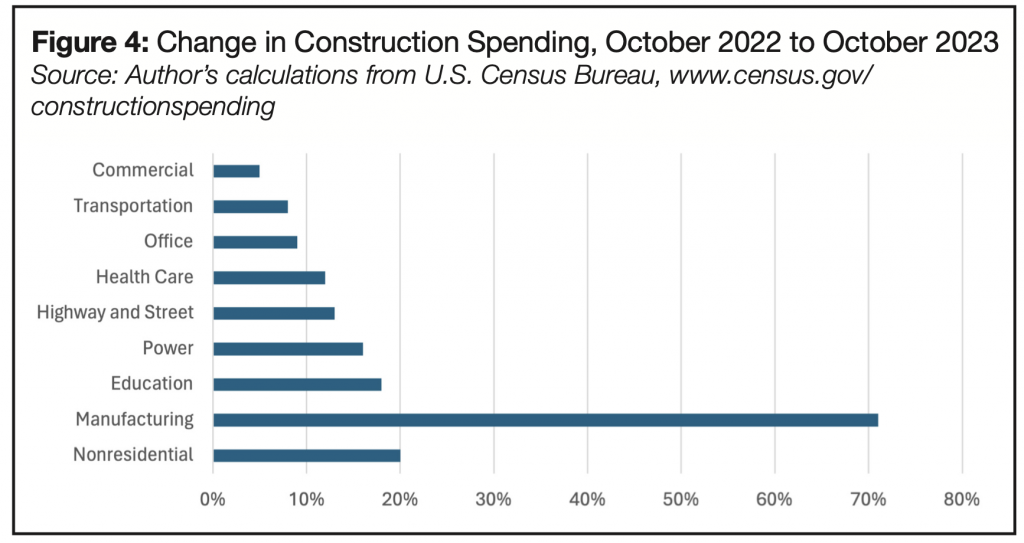

The construction industry, like the broader economy, escaped a recession in 2023. The outlook for 2024 remains positive overall but with some substantial swings in various sectors.

Construction spending topped $2 trillion at a seasonally adjusted annual rate (but without adjusting for inflation) by late summer 2023, according to the Census Bureau. Spending jumped nearly 11% from October 2022 to October 2023, with gains in all 16 nonresidential categories that the bureau reports on in its monthly release.

The fastest-growing category in 2023 was manufacturing construction, which jumped 71% over 12 months. The increase was led by electronics plants, such as the semiconductor fabrication facilities outside of Austin, Phoenix and Columbus, Ohio, along with more recent projects near Boise, Idaho, and Lehi, Utah. A host of electric vehicles, EV battery and component plants added to the growth spurt, despite a couple of postponements. In 2024, these segments are likely to continue increasing and be joined by numerous plants to serve the burgeoning renewable energy sector.

That sector also promises to be a growth market, with new solar, transmission and utility-scale battery storage projects. In addition, federal grants and tax credits may help launch construction for a variety of new technologies, such as alternative battery materials and carbon capture demonstration projects. These increments will offset a possible downturn in construction related to offshore wind.

Data centers remain a hot market (although, ironically and frustratingly, the Census Bureau doesn’t break out data on data center construction). Data centers are spreading to new areas as demand outstrips power supply in traditional locations such as northern Virginia. Rapid adoption of artificial intelligence is the latest driver of demand for data centers.

Infrastructure spending should finally get a boost from the Infrastructure Investment and Jobs Act. That bill became law more than two years ago but new requirements regarding U.S.-made materials, apprenticeship programs and prevailing-wage rates have slowed the awarding of contracts.

Partially offsetting these expanding segments, there are likely to be fewer warehouse and office projects. Developers are facing higher financing costs, tighter lending standards and flattening or falling rents. These unfavorable dynamics may also constrain retail and lodging construction.

As for residential construction, multifamily spending increased by 17% year-over-year in October. But the number of permits drawn for new multifamily units tumbled 28% from the previous October, implying a huge drop in apartment projects once current buildings are completed. Single-family homebuilding was down from a year earlier but by less than 2%, the smallest year-over-year decline since August 2022. In fact, single-family construction spending climbed every month since April. Thus, it appears likely that homebuilding will exceed 2023 levels, while apartment construction sags.

Contractors and owners enjoyed a respite from the soaring materials prices and delivery times that plagued construction in 2020 through mid-2022. But the holiday is not likely to last through 2024. An increase of 4% to 6% for materials costs seems possible. For the most part, the supply chain should not be a headache, with the major exception of electrical items such as switchgear and transformers. These products have had unprecedented and ever-growing lead times, and relief is not yet in sight.

For most contractors, labor availability will remain the number one headache. While job openings have slackened in the broader economy, construction employers still report record openings compared to the same month in previous years. With the construction unemployment rate down to 4% or so, it is clear that there are few jobseekers with construction experience who are currently out of a job and looking for one. Wages are likely to rise by 5% to 7%.

In short, there will still be plenty of projects in 2024 but not necessarily in the same categories as before. Materials and labor costs are both likely to climb more than in 2023.

Figure 4: Change in Construction Spending, October 2022 to October 2023

Source: Author’s calculations from U.S. Census Bureau, www.census.gov/constructionspending